What is the Medicare Savings Program?

The Medicare Savings Program (MSP) is a New York State Medicaid program that pays the cost of Medicare Part B. The Medicare Part B premium is about $174 per month. Many people with Medicare health insurance don’t realize they are paying for Medicare Part B because it is automatically deducted from their Social Security benefits. The Medicare Savings Program counts income only; there is no resource test. The income limits change every year.

What is Medicare health insurance?

Medicare is a federal health insurance program available to qualified individuals and certain dependents (spouses and/or adult disabled children). Most people qualify for Medicare when they turn 65 years of age, or were determined disabled by the Social Security Administration (SSA) and have received Social Security Disability benefits for 24 months. While others may qualify for Medicare because they have End Stage Renal Disease or ALS/Lou Gehrig’s disease.

How can the Medicare Savings Program help reduce my medical costs?

Medicare health insurance consists of several parts: Part A, hospital insurance for when you are hospitalized; Part B, medical insurance for all medical services you receive in the community (primary & specialist care, labs, X-rays, therapies etc.); and Part D, prescription drug coverage for when your doctor prescribes medication you get from a pharmacy. Some people with Medicare choose to enroll in Part C (Medicare Advantage), a type of Medicare health plan offered by private health insurance companies that must follow Medicare rules.

Even though Medicare is comprehensive health insurance, Medicare is not free. Everyone with Medicare has to pay a Medicare Part B premium unless they are enrolled in a program that helps them pay for it. This is why the Medicare Savings Program is so important. When you enroll in MSP, you will also automatically get Extra Help, the federal program that helps reduce and pay for most of your Medicare prescription drug (Part D) plan costs.

Many people with Medicare don’t realize they are paying $185 for Medicare Part B because it is automatically deducted from their Social Security check. To find out if you are paying for Medicare Part B, take a look at your most recent SSA award letter.

How can I qualify for the Medicare Savings Program?

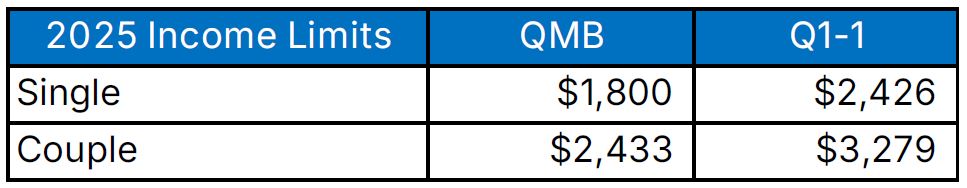

To qualify for the Medicare Savings Program, you need to be a New York State resident, have Medicare Part A, B, or both, and have gross monthly income below the MSP income limits. The MSP program has no asset or resource test. There are two types of MSPs: QMB & QI-1. The income limits change every year.

How can I apply for the Medicare Savings Program?

To apply for the Medicare Savings Program, you’ll need to:

- Submit a one page application to your local department of social services (in NYC, the Human Resources Administration, HRA);

- Provide copies of documents to prove your income, residency, Medicare status (a Medicare card), and age and identity (a picture identification that has your date of birth) for yourself and your spouse, if you live together.

An application for the Medicare Savings Program will be reviewed and decided in 45 days. You will receive a notice in the mail with the program’s decision. If approved, you will no longer have the Medicare Part B premium deducted from your Social Security check. If your application is denied or you don’t get a decision after 45 days, you can request an appeal (called a fair hearing) with the Office of Temporary & Disability Assistance (OTDA).

What should I do if I apply & I don’t hear back or I’m denied?

If you applied more than 45 days ago and never received a decision or you applied and received a denial letter, you should request an appeal (called a fair hearing) with the Office of Temporary & Disability Assistance (OTDA) by calling 1-800-205-0110. You can also contact us for legal help. Our citywide legal hotline (917-661-4500) is open Monday-Friday, 9:30am to 4pm.

Do I need to renew my Medicare Savings Program benefit?

Yes, you have to renew your Medicare Savings Program coverage yearly. If you do not complete and submit the MSP renewal form, which is sent to you by your local department of social services/HRA, your MSP coverage will end and you will start paying the Medicare Part B premium again. You should receive a notice in the mail before your MSP coverage ends for not renewing. You can file a fair hearing with the Office of Temporary and Disability Assistance (OTDA). You should file a fair hearing and seek legal assistance if your MSP case closes.

For free legal help, call Legal Services NYC at 917-661-4500 Monday through Friday from 9:30 a.m. to 4 p.m. Learn more about our intake process here.

* The information does not constitute legal advice. You should always consult an attorney regarding your matter. Legal help subject to capacity and location.

Join us. Demand Justice.

In this extraordinarily challenging moment, your partnership with LSNYC is critical. Please join us by making your gift today.